Service Contract Comprehensive Coverage

|

You may find the latest Terms and Conditions documents here. Please select the document that corresponds

to your country.

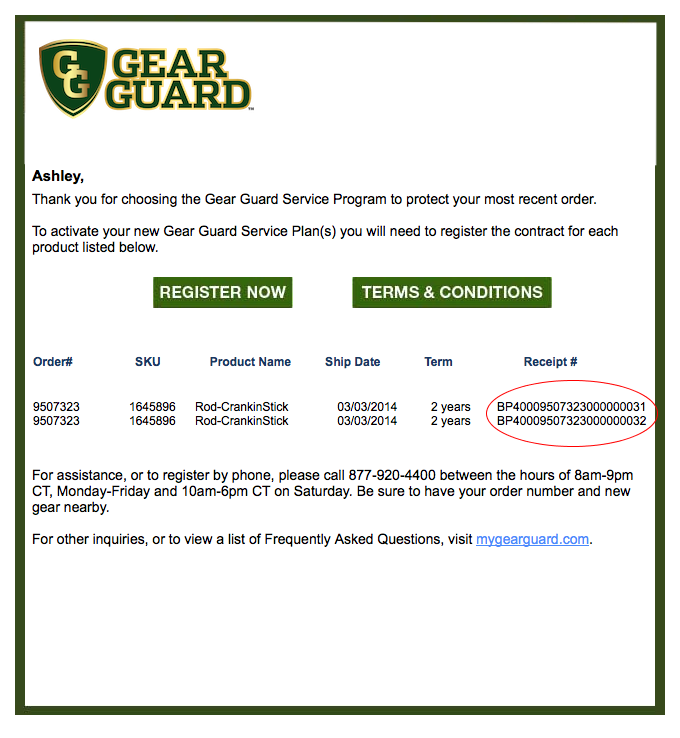

Thank You for Your recent purchase of the GearGuard coverage (the "Service Contract", "Contract"). We hope You enjoy the added peace of mind and protection this Contract provides. This document along with the receipt document (paper or e-mail) provided to You as proof of Your product and Contract purchase, that confirms the Plan selected by You, any additional benefits, and the coverage Term (the "Purchase Receipt"), constitutes the entire Service Contract between Us and You. Please keep this document along with your original Purchase Receipt, as You will need them to verify Your coverage at the time of Claim. Throughout this Service Contract, the words "We", "Us" and "Our" means the party obligated to provide service under this Service Contract as the service contract provider, who is Starr Protection Solutions, LLC ("SPS"), except in Florida, Oklahoma and Washington. In Oklahoma and Washington, the obligor is Starr Underwriting Agency, Inc. (Oklahoma License # 44200902) ("SUA"). SPS and SUA are located at 399 Park Avenue, 3rd Floor, New York, NY 10022, [(855) 438-2390]. In Florida, the obligor is Starr Indemnity & Liability Company located at 399 Park Avenue, 3rd Floor, New York, NY 10022, [(855) 438-2390].The words "You" and "Your" refer to the purchaser of the product covered by this Service Contract or to the person to whom this Service Contract was properly transferred. "Failure" refers to an operational or mechanical breakdown to Your covered product that occurs during normal use. This Service Contract is administered by White River Financial Services, L.L.C., [2500 East Kearney Street], Springfield, MO [65898], [1-877-920-4400] ("Administrator"). Please contact the Administrator if You have any questions about this Service Contract. |

|

If You have any questions, require customer service, or wish to report a claim, please visit: mygearguard.com, or contact the Administrator at [2500 East Kearney Street], Springfield, MO [65898], [1-877-920-4400]. SPECIAL STATE DISCLOSURES : Regulation of service plans may vary widely from state to state. Any provision within this Agreement, which conflicts with the laws of the state where You reside, shall automatically be considered to be modified in conformity with applicable state laws and regulations as set forth below. The following state specific requirements apply if Your Protection Plan was purchased in one of the following states and supersede any other provision within Your Protection Plan terms and conditions to the contrary. ALABAMA only: You may return this Protection Plan within twenty (20) days of the date this Protection Plan was provided to You or within ten (10) days if this Protection Plan was delivered to You at the time of sale. If You made no claim, this Protection Plan is void and the full purchase price will be refunded to You. If You cancel this Protection Plan after the first 20 days, You will receive the unearned portion of the full purchase price of this Protection Plan, less an administrative fee of up to twenty-five dollars ($25.00). To arrange for cancellation of this Plan, please contact Your Seller. The Obligor will pay a penalty of ten percent (10%) per month on a refund that is not paid or credited within forty-five (45) days after return of the Protection Plan to the Obligor. Obligations of the Obligor are backed by the full faith and credit of the Obligor, as well as by a service contract reimbursement policy. If the Obligor fails to pay or to provide service on a claim within sixty (60) days after proof of loss has been filed, the contract holder is entitled to submit a claim directly to Starr Indemnity & Liability Company, who insures the Obligor's obligations under this Protection Plan, at [(855) 438-2390] or 399 Park Ave 3rd Floor, New York, NY 10022. These provisions apply only to the original purchaser of this Protection Plan. In the event the Obligor cancels this Protection Plan, the Obligor will mail a written notice to You at Your last known address at least five (5) days prior to cancellation which shall state the effective date of cancellation and the reason for cancellation. However, prior notice is not required if the reason for cancellation is nonpayment of the provider fee or a material misrepresentation by You relating to the covered property or its use. ARIZONA only Definitions: A "Consumer" means a contract holder, inclusive of a buyer of the Covered Product (other than for re- sale), any person to whom the Covered Product is transferred to during the duration of the Coverage Term, or any person entitled to receive performance on the part of the Obligor under applicable law. "Service Dealer" is any person or entity that performs or arranges to perform services pursuant to a service contract which the Service Dealer issues. "Protection Plan Administrator" means an entity which agrees to provide contract forms; process claims and procure insurance for and on behalf of a Service Dealer in performance of the obligations pursuant to a service contract, but which may not itself perform actual repairs. All references to the denial of coverage or exclusion from coverage for pre-existing conditions shall not apply in cases where such conditions were known, or should reasonably have been known, by Us or the Seller. All references to denial or exclusion from coverage are applicable only if they happened while the product was owned by you. Cancellation: If Your written notice of cancellation is received prior to the expiration date, We will provide a pro rata refund after deducting for administrative expenses associated with the cancellation, regardless of prior services rendered against the Plan. No claim incurred or paid shall be deducted from the amount of the refund. The cancellation provision shall not contain both a cancellation fee and a cancellation penalty. The administrative expenses may not exceed $75 dollars or ten percent of the purchase price of the service contract, whichever is less. To arrange for cancellation of this Plan, please contact Your Seller. Starr Protection Solutions, LLC is the Provider and the Obligor for this Protection Plan in Arizona. Dispute Resolution: Both parties must agree to arbitration. Additionally, as an Arizona resident you may follow the process to resolve complaints under the provisions of A.R.S. §§20-1095.09 and 20-461, Unfair Trade Practices, as outlined by the Arizona Department of Insurance and Financial Institutions. You have a right to file a complaint with the Department of Insurance and Financial Institutions against Us by contacting the Department of Insurance and Financial Institutions at 602-364-2499 or difi.az.gov. CALIFORNIA only: With respect to California contract holders, the Administrator under this Protection Plan is White River Financial Services, L.L.C. The Obligor under this Protection Plan is Starr Protection Solutions LLC. This Protection Plan may be canceled by the contract holder for any reason, including, but not limited to, the Product covered under this contract being sold, lost, stolen or destroyed. If You decide to cancel this Protection Plan, and cancellation notice is received by the Seller within 60 days of the date You received this Protection Plan, and You have made no claims against this Protection Plan, You will be refunded the full Protection Plan price, less any claims; or if this Protection Plan is canceled by written notice after 60 days from the date You received this Protection Plan, You will be refunded a prorated amount of the Protection Plan price, less any claims paid or less an administrative fee of 10% of the Protection Plan price or $25, whichever is less, unless otherwise precluded by law. To arrange for cancellation of this Plan, please contact Your Seller. COLORADO only: Action under this Protection Plan may be covered by the provisions of the "Colorado Consumer Protection Act" or the "Unfair Practices Act," Articles 1 and 2 of Title 6, C.R.S. A party to this Protection Plan may have a right of civil action under the laws, including obtaining the recourse or penalties specified in such laws. CONNECTICUT only: The term of this Protection Plan is automatically extended by the length of time in which the Covered Product is in the Obligor's custody for repair under this Protection Plan. In the event of a dispute with the Obligor, You may contact the State of Connecticut Insurance Department: P.O. Box 816, Hartford, CT 06142-0816, Attn: Consumer Affairs. The written complaint must contain a description of the dispute, the purchase or lease price of the Product, the cost of repair of the Product, and a copy of this Protection Plan. If the Obligor fails to pay or to provide service on a claim within sixty (60) days after proof of loss has been filed, the service contract holder is entitled to submit a claim directly to Starr Indemnity & Liability Company who insures the Obligor's obligations under this Protection Plan, at [(855) 438-2390] or 399 Park Ave, 3rd Floor, New York, NY 10022. FLORIDA only: The Obligor under this Protection Plan is Starr Indemnity & Liability Company. The Administrator under this Protection Plan is White River Financial Services, L.L.C. If You cancel this Protection Plan, You will receive a refund equal to 90% of the unearned pro rata purchase price of the Protection Plan, less any claims that have been paid or less the cost of repairs made on Your behalf. To arrange for cancellation of this Plan, please contact Your Seller. If We cancel this Protection Plan, You will receive one hundred percent (100%) of the unearned pro rata purchase price of this Protection Plan, less any claims paid or the cost of repairs made on Your behalf. The rates charged for this Protection Plan are not subject to regulation by the Florida Office of Insurance Regulation. GEORGIA only: You may cancel this Protection Plan at any time by notifying the Seller in writing or by surrendering this Protection Plan to the Seller, whereupon the Seller will refund the unearned pro rata purchase price based on the time remaining on the request for cancellation. To arrange for cancellation of this Plan, please contact Your Seller. The Obligor is also entitled to cancel this Protection Plan at any time based upon fraud, misrepresentation, nonpayment of fees by You, or non-renewal. All references to the denial of coverage or exclusion from coverage for pre-existing conditions shall not apply in cases where such conditions were known, or should reasonably have been known, by Us or the Seller. Procedures for cancellation of this Protection Plan will comply with section 33-24-44 of the Georgia code. Administrator may cancel this Protection Plan upon thirty (30) days written notice to You. If a claim for service has not been completed within sixty (60) days after proof of loss has been filed with the Obligor, the claim can be submitted to Starr Indemnity & Liability Company who insures the Obligor's obligations under this Protection Plan at [(855) 438-2390] or 399 Park Ave, 3rd Floor, New York, NY 10022. HAWAII only: You may return this Protection Plan within thirty (30) days of the date this Protection Plan was provided to You or within twenty (20) days if this Protection Plan was delivered to You at the time of sale. If You made no claim, this Protection Plan is void and the full purchase price will be refunded to You. To arrange for cancellation of this Plan, please contact Your Seller. The Obligor will pay a penalty of ten percent (10%) on a refund that is not paid or credited within forty-five (45) days after return of this Protection Plan to the Seller. These provisions apply only to the original purchaser of this Protection Plan. In the event the Obligor cancels this Protection Plan, We will mail a written notice to You at Your last known address at least 5 days prior to cancellation which shall state the effective date of cancellation and the reason for cancellation. However, prior notice is not required if the reason for cancellation is nonpayment of the provider fee, a material misrepresentation by You relating to the Covered Product or its use, or a substantial breach of Your duties relating to the Covered Product or its use. Obligations of the Obligor under this Protection Plan are insured under a service contract contractual liability policy issued by Starr Indemnity & Liability Company, 399 Park Ave, 3rd Floor, New York, NY 10022. If You have a question or complaint, You may contact the Insurance Commissioner, Hawaii Insurance Division, PO Box 3614, Honolulu, Hawaii, 96811. ILLINOIS only: Starr Protection Solutions, LLC, (and not the dealer or manufacturer), is the Obligor under this Protection Plan in the State of Illinois. The Obligor will pay the cost of covered parts and labor necessary to restore the Product (s) to normal operating condition as a result of covered or mechanical component failure due to normal wear and tear. You may cancel this Protection Plan at any time. If You cancel this Protection Plan within the first thirty (30) days of purchase and if no service has been provided to You, You shall receive a full refund of the purchase price less a cancellation fee equal to the lesser of ten percent (10%) of the purchase price or fifty dollars ($50.00). If You cancel this Protection Plan at any other time or if You cancel after service has been provided to You, You shall receive a refund equal to the pro rata purchase price less the value of any service received and less a cancellation fee equal to the lesser of ten percent (10%) of the purchase price or fifty dollars ($50.00). To arrange for cancellation of this Plan, please contact Your Seller. If the Obligor fails to pay or to provide service on a claim within sixty (60) days after proof of loss has been filed, the service contract holder is entitled to submit a claim directly to Starr Indemnity & Liability Company which insures the Obligor's obligations under this Protection Plan at the following address: 399 Park Avenue, 3rd Floor, New York, NY 10022. INDIANA only: If a claim for service has not been completed within sixty (60) days after proof of loss has been filed with the Obligor, the claim can be submitted to Starr Indemnity & Liability Company, who insures the Obligor's obligations under this Protection Plan, at 399 Park Avenue, 3rd Floor, New York, NY 10022. KENTUCKY only: If processing of a claim for service has not been completed within sixty (60) days after proof of loss has been filed with the Obligor, the claim may be submitted to Starr Indemnity & Liability Company who insures the Obligor's obligations under this Protection Plan at 399 Park Avenue, 3rd Floor, New York, NY 10022. MISSOURI only: The following provisions apply only to the original purchaser of this Protection Plan, and only if no claim has been made prior to the return of this Protection Plan: You may return this Protection Plan within twenty (20) days of the date this Protection Plan was mailed to You or within ten (10) days if this Protection Plan was delivered to You at the time of sale. If You made no claim under this Protection Plan, the Plan is void and the full purchase price will be refunded to You or credited to Your account. To arrange for cancellation of this Plan, please contact Your Seller. The Obligor will pay a penalty of ten percent (10%) on a refund that is not paid or credited within forty-five (45) days after return of this Protection Plan to the Seller. The Deductible (if applicable) is a non-refundable amount You will be assessed, per Claim, prior to receiving covered services under this Protection Plan, as indicated on the purchase confirmation page. The following sentence is added as the last sentence of Section E What to do if you require service: If it is an emergency and We cannot be reached, You can proceed with repairs. We will reimburse You or the repairing facility in accordance with the Protection Plan provisions. NEVADA only: This Protection Plan is renewable at Our option. This Protection Plan is not an insurance policy. This Protection Plan does not provide replacement or service coverage for failures or breakdowns arising from pre-existing conditions or for any form of consequential damages. The purchase price is as indicated on the bill of sale or receipt or declarations page and is considered to be a part of the contract. The cancellation provision in this Protection Plan is hereby deleted and replaced with the following: This Protection Plan is void and We will refund to You the purchase price of this Protection Plan, if no service or replacement claim has been made and You return the contract to Us:

To arrange for cancellation of this Plan, please contact Your Seller. We will refund to You the purchase price of this contract within 45 days after it has been returned to us. If We do not refund the purchase price within 45 days, We will pay You a penalty of 10 percent (10%) of the purchase price for each 30-day period that the refund remains unpaid. You may also cancel this Protection Plan at any other time and receive a refund equal to the pro rata purchase price. These provisions apply only to the original purchaser of this Protection Plan. We may not cancel this contract once it has been in effect for at least seventy (70) days, except for the following conditions:

NEW HAMPSHIRE only: In the event You do not receive satisfaction under this Protection Plan, You may contact the New Hampshire Insurance Department at 21 South Fruit Street, Suite 14, Concord, NH 03301, 1 (800) 852-3416. The obligations under this Protection Plan are insured by a contractual liability policy issued by Starr Indemnity & Liability Company located at 399 Park Ave., 3rd Floor, New York, NY 10022. In the event any covered service is not paid within sixty (60) days after proof of loss has been filed or the Obligor ceases to do business or goes bankrupt, You may file Your claim directly with Starr Indemnity & Liability Company. NEW MEXICO only: You may return this Protection Plan within ninety (90) days of the date this Protection Plan was provided to You. If You made no claim, the Agreement is void and the full purchase price will be refunded to You. To arrange for cancellation of this Plan, please contact Your Seller. The Obligor will pay a penalty of ten (10%) percent per month on a refund that is not made within sixty (60) days of the return of this Protection Plan. These provisions apply only to the original purchaser of this Protection Plan. We may not cancel this Protection Plan once it has been in effect for seventy (70) days except for the following conditions:

NEW YORK only: The obligations of the Obligor under this Protection Plan are insured under a service contract reimbursement insurance policy issued by Starr Indemnity & Liability Company. If the Obligor fails to perform under this Agreement, including failure to return any unearned fee in the event of cancellation, Starr Indemnity & Liability Company will pay all sums the Obligor is legally obligated to pay under this Agreement or perform any service the Obligor is legally obligated to perform under this Agreement. You may return this Protection Plan within twenty (20) days of the date this Protection Plan was provided to You or within ten (10) days, if this Protection Plan was delivered to You at the time of sale. If You made no claim, this Protection Plan is void and the full purchase price will be refunded to You. To arrange for cancellation of this Plan, please contact Your Seller. We will pay a penalty of ten percent (10%) per month on a refund that is not made within thirty (30) days of return of this Protection Plan. These provisions apply only to the original purchaser of this Protection Plan In the event We cancel this Protection Plan, We will mail a written notice to You at Your last known address at least fifteen (15) days prior to cancellation with the reason for cancellation. A written notice is not required, if the reason for cancellation is nonpayment of the provider fee, a material misrepresentation, or a substantial breach of duties by You relating to the Covered Product or its use. If a claim for service has not been completed within sixty (60) days after proof of loss has been filed, the claim can be submitted to Starr Indemnity & Liability Company located at 399 Park Ave, 3rd Floor, New York, NY 10022, [(855) 438-2390]. NORTH CAROLINA only: The purchase of this Protection Plan is not required in order to obtain financing. We may not cancel this Protection Plan except for nonpayment by You or for violation of any of the terms and conditions of this Protection Plan. If You cancel this Protection Plan, You will receive a pro-rata refund, less the cost of any claims paid and less a cancellation fee of ten percent (10%) of the amount of the refund. To arrange for cancellation of this Plan, please contact Your Seller. Obligations under this Protection Plan are insured by Starr Indemnity & Liability Company, 399 Park Ave., 3rd Floor, New York, NY 10022. OKLAHOMA only: The Obligor under this Protection Plan is Starr Underwriting Agency, Inc. (License # 44200902). This plan is a service agreement and is not an insurance policy. The Cancellation conditions do not apply to Oklahoma state residents. In the event You cancel this Protection Plan, You shall receive a refund equal to ninety percent (90%) of the unearned pro-rata purchase price less the cost of any service received. To arrange for cancellation of this Plan, please contact Your Seller. In the event We cancel this Protection Plan, You shall receive a refund equal to one hundred percent (100%) of the unearned pro-rata purchase price, less the cost of any service received. This is not an insurance contract. Coverage afforded under this contract is not guaranteed by the Oklahoma Insurance Guaranty Association. While arbitration is mandatory, the outcome of any arbitration shall be nonbinding on the parties, and either party shall, following arbitration, have the right to reject the arbitration awarded and bring suit in a district court of Oklahoma. OREGON only: Arbitration: If You are a resident of Oregon, the following shall replace all references to Arbitration in these Terms and Conditions: Arbitration is not mandatory and has to be by mutual agreement. Any arbitration occurring under this Protection Plan shall occur in an agreed upon location by both parties and be administered in accordance with the Expedited Procedures of the Commercial Arbitration Rules of the American Arbitration Association (the "Arbitration Rules") unless any procedural requirement of the Arbitration Rules is inconsistent with the Oregon Uniform Arbitration Act in which case the Oregon Uniform Arbitration Act shall control as to such procedural requirement. Any award rendered shall be a nonbinding award against You. SOUTH CAROLINA only: In order to prevent damage to the Covered Product, please refer to the owner's manual. This Protection Plan does not provide coverage for pre-existing conditions. This Protection Plan does not cover repair and replacement necessitated by loss or damage resulting from 1) any cause other than normal use and operation of the Product in accordance with manufacturer's specifications and/or owner's manual or 2) failure to use reasonable means to protect Your Product from further damage after a breakdown or performance failure occurs. You may return this Protection Plan within twenty (20) days of the date this Protection Plan was provided to You, or within ten (10) days, if this Protection Plan was delivered to You at the time of sale. If You made no claim, this Protection Plan is void and the full purchase price will be refunded to You. To arrange for cancellation of this Plan, please contact Your Seller. We will pay a penalty of ten percent (10%) per month on a refund that is not made within forty- five (45) days of return of this Protection Plan. These provisions apply only to the original purchaser of this Protection Plan. In the event We cancel this Protection Plan, We will mail a written notice to You at Your last known address at least fifteen (15) days prior to cancellation with the reason for cancellation. The written notice is not required if the reason for cancellation is nonpayment of the provider fee, a material misrepresentation, or a substantial breach of duties by You relating to the covered property or its use. If a claim for service has not been completed within sixty (60) days after proof of loss has been filed, the claim can be submitted to Starr Indemnity & Liability Company, which insures the obligations under this Protection Plan, located at 399 Park Ave., 3rd Floor, New York, NY 10022. In the event You have a question or complaint, You may contact the South Carolina Department of Insurance, P.O. Box 100105, Columbia, South Carolina, 29202-3105, (803) 737-6134. TEXAS only: You may return this Protection Plan within twenty (20) days of the date this Service Contract was provided to You or within ten (10) days if this Protection Plan was delivered to You at the time of sale. If You made no claim, this Protection Plan is void and the full purchase price will be refunded to You. To arrange for cancellation of this Plan, please contact Your Seller. We will pay a penalty of ten (10) percent of the amount outstanding per month on a refund that is not made within forty-five (45) days. These provisions apply only to the original purchaser of this Protection Plan . In the event We cancel this Protection Plan, We will mail a written notice to You at Your last known address at least five (5) days prior to cancellation which shall state the effective date of cancellation and the reason for cancellation. However, prior notice is not required if the reason for cancellation is nonpayment of the provider fee, a material misrepresentation by You relating to the covered property or its use, or a substantial breach of Your duties relating to the covered Product or its use. Obligations of the provider under this Protection Plan are insured under a service contract reimbursement policy. In the event a covered service is not provided by Us within sixty (60) days after proof of loss has been filed, the claim can be submitted to Starr Indemnity & Liability Company located at 399 Park Ave, 3rd Floor, New York, NY 10022. Unresolved complaints concerning a provider or questions concerning the registration of a service contract provider may be addressed to the Texas Department of Licensing and Regulations, PO Box 12157, Austin TX 78711, 1 (800) 803-9202. UTAH See Utah specific contract here. VERMONT only: You may return this Protection Plan within twenty (20) days of receipt and, if no claim for service has been made, receive a full refund of the purchase price. To arrange for cancellation of this Plan, please contact Your Seller. Our obligations under this Protection Plan are supported by a contractual liability insurance policy issued by Starr Indemnity & Liability Company. In an event that We are unable to perform under the contract, Starr Indemnity & Liability Company, which shall pay on Our behalf any sums We are legally obligated to pay and shall provide the service, which We are legally obligated to perform according to the Our contractual obligations under this Protection Plan. If a claim for service has not been completed within sixty (60) days after proof of loss has been filed with Us, the claim can be submitted to Starr Indemnity & Liability Company located at 399 Park Avenue, 3rd Floor, New York, NY 10022, [(855) 438-2390]. VIRGINIA only: If any promise made in the contract has been denied or has not been honored within 60 days after your request, you may contact the Virginia Department of Agriculture and Consumer Services, Office of Charitable and Regulatory Programs at www.vdacs.virginia.gov/food-extended-service-contract-providers.shtml to file a complaint. WASHINGTON only: The "Insured Agreement" provision of these Terms and Conditions as set forth above is deleted in its entirety and replaced with the following: This is not an insurance policy. Obligations of the service contract obligor under this Protection Plan are backed by the full faith and credit of the service contract obligor, Starr Underwriting Agency, Inc., located at 399 Park Avenue, 3rd Floor, New York, NY 10022. You may contact them toll-free at [(855) 438-2390]. WISCONSIN only: THIS CONTRACT IS SUBJECT TO LIMITED REGULATION BY THE OFFICE OF THE COMMISSIONER OF INSURANCE. Arbitration: If You are a resident of Wisconsin, the following shall replace all references to Arbitration in these Terms and Conditions: Arbitration is not mandatory and has to be by mutual agreement. If a claim for service has not been completed within sixty (60) days after proof of loss has been filed with Us, or if the provider becomes insolvent or otherwise financially impaired, the claim can be submitted to Starr Indemnity & Liability Company, who insures Our obligations under this Protection Plan, located at 399 Park Avenue, 3rd Floor, New York, NY 10022, [(855) 438-2390]. You may return this Protection Plan within twenty (20) days of the date this Protection Plan was mailed to You, or within ten (10) days, if this Protection Plan was delivered to You at the time of sale. If You made no claim, this Protection Plan is void and the full purchase price will be refunded to You or credited to Your account. To arrange for cancellation of this Plan, please contact Your Seller. We will pay a penalty of ten (10) percent per month on a refund that is not paid or credited within forty-five (45) days after return of this Protection Plan to Us. If We cancel this Protection Plan, We will provide You at least 5 days written notice prior of cancellation stating the effective date and reason. These provisions apply only to the original purchaser of this Protection Plan. In the event that You experience a total loss of property covered by this contract that is not covered by a replacement of the property pursuant to the terms of the contract, You shall be entitled to cancel this contract and receive a pro rata refund of any unearned provider fee, less any claims paid. Lack of pre-authorization shall be the sole grounds for a claim denial; however, unauthorized repairs may not be covered if evaluated to have been at an unreasonable expense. WYOMING only: You may return this Protection Plan within twenty (20) days of the date this Protection Plan was provided to You, or within ten (10) days, if this Protection Plan was delivered to You at the time of sale. If You made no claim, this Protection Plan is void and the full purchase price will be refunded to You. To arrange for cancellation of this Plan, please contact Your Seller. We will pay a penalty of ten (10) percent on a refund that is not paid or credited within forty-five (45) days after return of this Protection Plan to Us. These provisions apply only to the original purchaser of this Protection Plan. In the event We cancel this Protection Plan, We will mail a written notice to You at Your last known address at least ten (10) days prior to cancellation, which shall state the effective date of cancellation and the reason for cancellation. However, prior notice is not required, if the reason for cancellation is nonpayment of the provider fee, a material misrepresentation by You relating to the Covered Product or its use, or a substantial breach of Your duties relating to the Covered Product or its use. Obligations under this Protection Plan are insured by Starr Indemnity & Liability Company located at 399 Park Avenue, 3rd Floor, New York, NY 10022. |

|